As spring arrives and the weather warms up, many people turn their attention to cleaning out closets and organizing their homes. According to a recent survey, about 80% of Americans have spring cleaning on their radar this year. 1 While most focus on the physical space, spring is also a great time to get your financial house in order. Refreshing your financial habits can reduce stress, provide structure, and uncover new opportunities to save money...

In this month’s market update video, Ivan Gruhl, CFA®, Co-Chief Investment Officer at Avantax recaps returns for April and then provides an update on the US Dollar, the economic landscape, first quarter earnings and our outlook going forward.

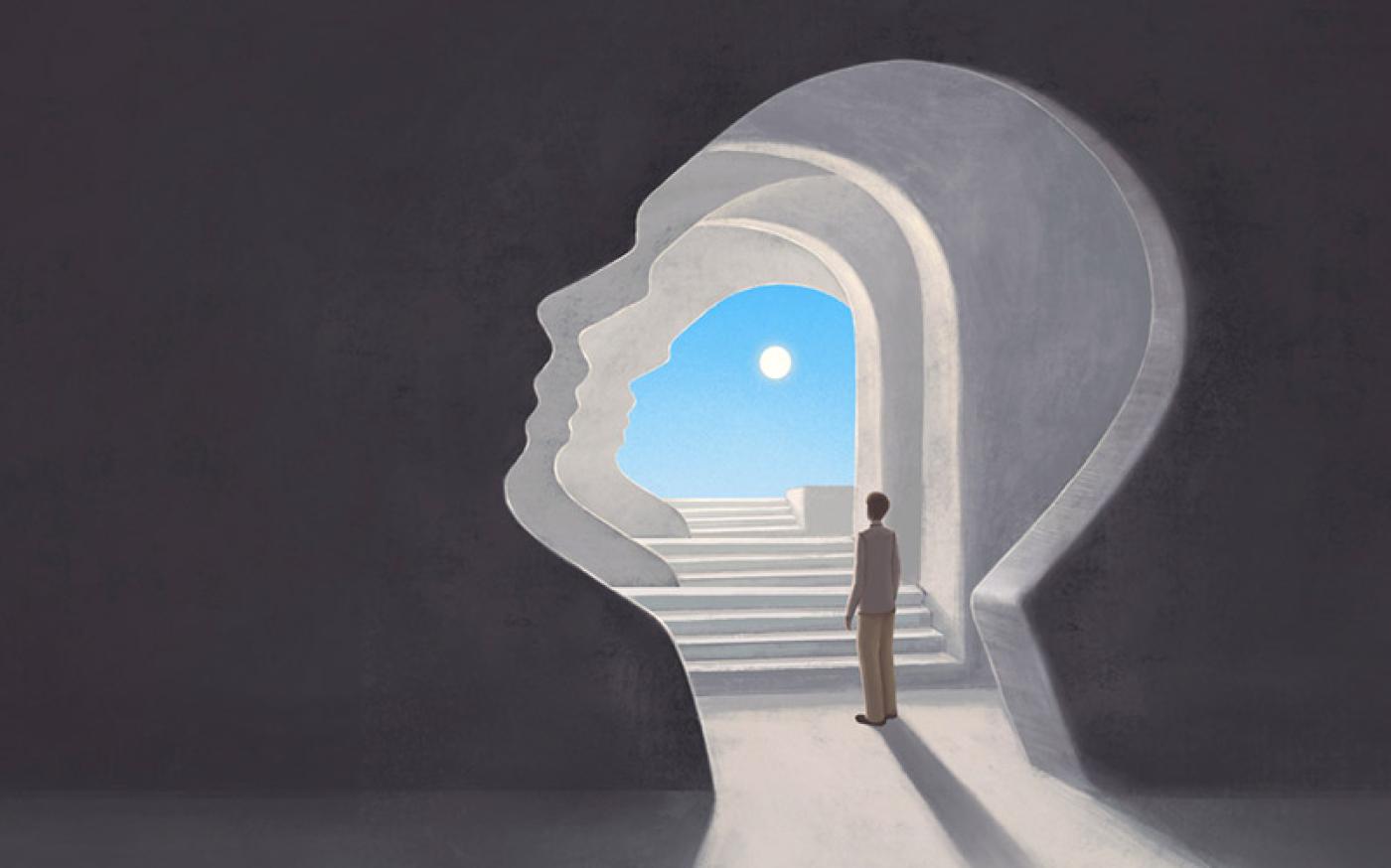

What makes one investor stick with their strategy through market swings while another panics and pulls out? Often, it comes down to mindset. Your investing mindset can shape how you make decisions, respond to volatility, and pursue financial goals.1 Without a strategy that aligns with that mindset, it’s easy to make impulsive choices or lose sight of your long-term plan. The good news? You don’t have to be a market expert to invest. By understanding...

Tax season might not spark joy, but a refund sure can. In 2025, the IRS estimates the average federal income tax refund will top $3,170. 1 That means a lot of folks are suddenly asking the same question: What should I do with it? Splurge? Save? Invest? The good news: there’s no one-size-fits-all answer. But there are a few options that tend to deliver more peace of mind and long-term upside. Here are five smart...

In this month’s market update video, Ivan Gruhl, CFA®, Co-Chief Investment Officer at Avantax recaps returns for March and then shifts to an update on the economy, earnings and our outlook going forward.

What do you do when faced with a complex financial challenge? Do you seek an immediate solution, or do you take the time to fully understand the issue before acting? The way you approach financial decisions often depends on your perception of time - specifically, how much time you believe you have to respond. 1 When dealing with complex financial matters, urgency can sometimes create pressure on us to act quickly. However, reacting too quickly...

Tax season doesn’t have to feel like an uphill battle. With the right strategies, you can minimize your tax bill and keep more of your hard-earned money where it belongs, in your pocket. Whether you’re a DIY tax filer or rely on a pro, understanding these key moves can help you make smarter financial decisions and sidestep costly mistakes. Let’s dive in. 1. Adjust Your Withholding to Avoid Surprises Getting a big refund might feel...

In this month’s market update video, Ivan Gruhl, CFA®, Co-Chief Investment Officer at Avantax provides a recap of returns for February and then shifts to an update on policies in Washington, a slowing economy and our outlook going forward.

What will happen to your business when it’s time for you to take a step back? That can be a tough question that many business owners eventually have to face. Yet, far too many admit they don't have a formal succession plan in place. In fact, looking at family businesses alone, about 61% say they do not have a documented succession plan. 1 Why? Many business owners say they haven’t put together a succession plan...

Market volatility can feel like a rollercoaster. Thrilling on the way up, stomach-churning on the way down. Even seasoned investors get a little uneasy when the market takes a dive. But here’s the thing: While market fluctuations are inevitable, maintaining a disciplined investment approach has historically helped investors stay on track toward their financial goals. If market swings make you nervous, don’t worry. You’re not alone. We’re going to walk through some key strategies to...

In this month’s market update video, Ivan Gruhl, CFA®, Co-Chief Investment Officer at Avantax, recaps returns for January and then shifts to an update on 4th quarter earnings, policies and our outlook going forward.

What financial habits have helped you most in life? Which ones have held you back? No matter how you answer those questions, your money habits have a lot to do with how you grew up. 1 They also can be shaped by when you grew up. That’s because each generation can have a distinct perspective and different experiences shaping their approach to money and financial choices. With that, every generation can bring its own strengths...